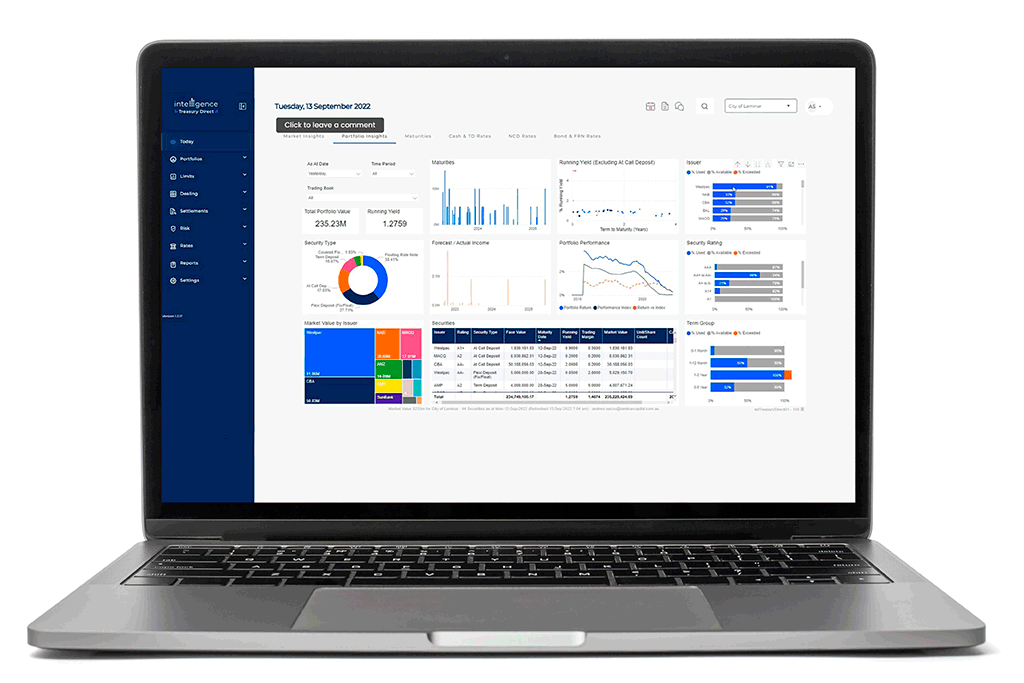

Treasury Direct is an innovative, cloud-based investment management SaaS platform that automates time-intensive processes, helps reduce the risk of human error and connects investors and issuers with the market. Designed specifically for mid-market investors and the financial services industry to simplify the management of their investment portfolio, it delivers end-to-end workflow, compliance and advanced real-time custom reporting.

Automating portfolio and investment management

Flexible and intuitive trading platform

A cloud-based platform, Treasury Direct has processed over 100,000 transactions and now has over $25 billion of funds administered on the platform*. Developed and hosted in Australia using verified cloud technology, Treasury Direct has been built to drive efficiencies and effectiveness with the enhanced compliance and data security.

Treasury Direct allows you to:

- Manage your entire portfolio online – fixed income, equities and borrowings

- Set and monitor your investment policy limits and utilise pre trade limit checking to automatically manage limits at the time of deal entry.

- Obtain portfolio performance and benchmark it to a wide range of indexes

- Leverage Austraclear settlement and deal authorisation workflows

- Access competitive term deposit and security rates from over 55 ADIs

- Produce custom or use over 70 preformatted reports

Versatile use across industries

Local councils

Treasury Direct is designed to help local councils and government departments use their resources effectively, efficiently and professionally with smart, automated features and independent valuations.

Universities

Treasury Direct can allow our university clients to report seamlessly on cash assets managed in-house together with outsourced managed funds across all asset classes. Powerful business intelligence and comprehensive reporting can deliver significant time saving to busy finance officers.

Not-for-profits

Treasury Direct can give busy finance officers something that cannot be manufactured. Time. By simplifying the investment and reporting process, our customers can enjoy significant efficiency gains and can be confident that the information provided by the platform helps ensure compliance with investment policies.

Religious bodies

Treasury Direct can give investment officers the confidence that they have the tools on hand to help manage a wide range of fixed interest investment types as they look for alternatives to help improve investment returns.

ADIs

Treasury Direct is designed to help Authorised Deposit-taking Institutions efficiently and accurately monitor their MLH and Non-MLH investment portfolios with smart online investment administration, management, limit tracking and reporting.

Fund managers

Treasury Direct can provide fund managers tools in a simple to use interface. Automated portfolio performance to any chosen benchmark together with portfolio risk analysis tools can make Treasury Direct a smart alternative to spreadsheets.

Wealth advisers

Treasury Direct can give wealth advisers the ability to settle and manage small parcels of over-the-counter, fixed-interest securities in a simple and efficient manner. Integrated Austraclear settlements and custodial services provides an out-of-the-box solution.

Health Funds

Treasury Direct can help our clients including health funds identify investment opportunities across cash, term deposits and fixed interest investments from over 55 ADIs. Treasury Direct combined with the professional dealing team at Laminar Capital can provide our clients with attractive results.

What our clients say

When LLL Australia became the first Charitable ADI in Australia it needed to partner with an investment specialist who could understand LLL uniqueness. The Laminar Capital Treasury Direct platform provided LLL with a management system that was innovative, easy to use and met our reporting requirements.

Treasury Direct is easy to navigate and simple to use. The ability to access the best term deposit rates brokerage free and have access to a large range of bonds and FRNs directly within the system should produce cost savings as third party brokers will not be required.

Of all the systems we reviewed, Treasury Direct was the most complete package. Treasury Direct is a compelling value proposition as we are confident we have everything at our disposal to successfully manage our client relationships.

The PTO was previously using a less sohisticated platform that focussed on one aspect of the investment process. Shifting to Teasury Direct was like chalk and cheese. The combination of Treasury Direct and Laminar Capital’s investment services is a great solution

Experience matters

Laminar Capital has leveraged its deep market knowledge, strong commercial relationships and innate understanding of client needs to develop Treasury Direct – a powerful SaaS platform, for online investment management. Designed by Laminar Capital’s treasury and investment experts specifically for treasury and investment managers, Treasury Direct, is also supported by a team of IT professionals. Specialist IT support allows for easy onboarding and guaranteed ongoing assistance – should you need it. The intuitive, cloud-based platform is live 24/7 and is capable of managing multiple investment and debt portfolios and covers numerous complex instruments.

Get in touch

Contact us today to discuss how we can strengthen your fixed income opportunities and support your treasury processes.

Laminar Capital services are provided by Perpetual Digital Pty Ltd ABN 62 626 891 978 (Perpetual). Laminar Capital Pty Ltd ABN 33 134 784 740, AFSL Number 476686.

Laminar Capital is part of the Perpetual Group (Perpetual Limited ABN 86 000 431 827, including its subsidiaries).

Treasury Direct is provided by Laminar Capital Pty Ltd 2021 ABN 33 134 784 740, AFSL Number 476686. This publication contains general information for wholesale clients only and is not intended to provide you with financial advice. Laminar Capital is part of the Perpetual Group (Perpetual Limited ABN 86 000 431 827, including its subsidiaries).

*Source: Perpetual Limited FY21 results presentation, 19 Australia 2021 https://perpetual.gcs-web.com/static-files/cc08a457-611b-4525-94d2-92de4810b721